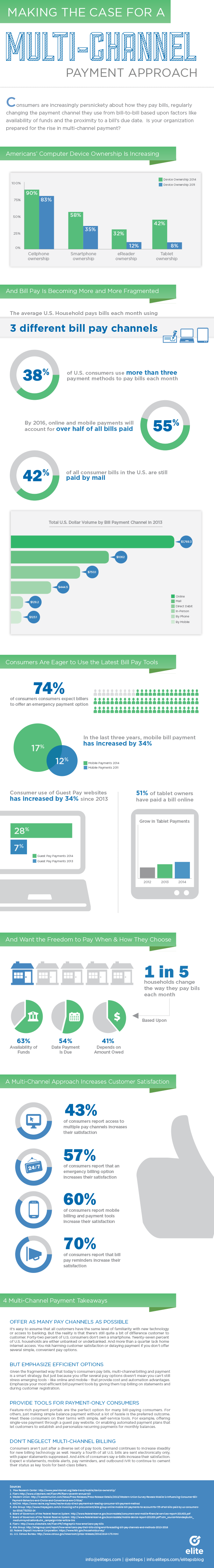

When it comes to bill payment, today’s consumers like to dabble. In a recent survey, seventy-six percent of consumers reported using multiple ways to pay a bill each month – some combination of mail-in, in-person, online, mobile and voice-based channels.

When it comes to bill payment, today’s consumers like to dabble. In a recent survey, seventy-six percent of consumers reported using multiple ways to pay a bill each month – some combination of mail-in, in-person, online, mobile and voice-based channels.

Why the all the indecision? Simple: consumers are increasingly leveraging the choice provided by a multi-channel mix to build more flexibility, convenience, and choice into the billing process.

For example, one-in-five changes the way they pay the same bill each month based upon factor such as the size of the balance owed, their financial situation, and the due date.

In other words, today’s consumers would like to pay when they want, using the pay channel they want.

And although that might sound like a recipe for disaster from a billing perspective, it’s mostly good news. Part of the reason for increased pay fragmentation is that consumers are getting more and more comfortable using emerging pay tools – like online, mobile, IVR – in addition to traditional options. That provides more process automation, fewer manual payment errors, and less staff involvement.

Not to mention encourages consumers to move away from traditional statement print and mail in favor of new, more efficient paperless billing tools like e-statements and mobile reminders – a shift that has the added benefit of helping accelerate consumer payment and reduce collection costs.

How have we arrived at today’s multi-channel payment environment? And what increased payment variety mean for your revenue cycle?

In the infographic below, you’ll learn about the state of multi-channel payment, along with four key takeaways that can help you intelligently build choice into your statement processing and payment operations.